Do Assets Affect Fafsa

For example the asset protection allowance for a parent age 65 or older was 84000 in 2009-10 but falls to 29600 in 2016-17. DONT include these investments as assets on the FAFSA.

How To Shelter Assets On The Fafsa

Certain assets affect FAFSA data so take time to understand asset savings and FAFSA reporting.

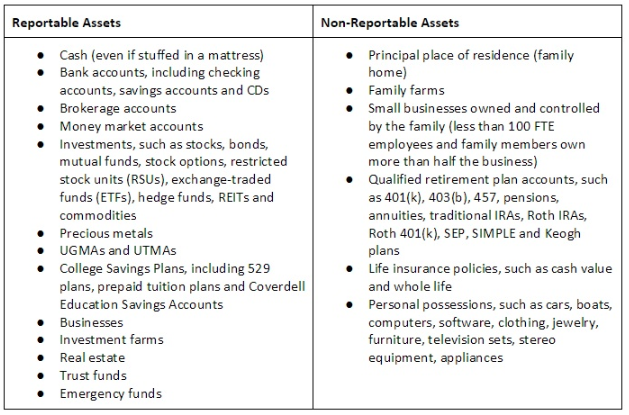

Do assets affect fafsa. Student and parent assets can affect the students chances of getting grants and other need-based financial aid. Equipment vehicles and nonexpendable commodities worth at least 1000 count as reportable assets. Which assets count and dont count.

Your RSUs impact your FAFSA in two ways. Family farm that you live on and operate. The value of life insurance.

Not all assets are treated equally under the Expected Family Contribution EFC formula the FAFSA uses. Selling them doesnt benefit you on the FAFSA since youre both creating additional capital gainincome assuming the price has gone up since the shares vested and your asset that was the stock share is now cash which is the same from the FAFSAs perspective. Need-based financial aid includes Federal Pell Grants subsidized federal student loans and the opportunity to enroll in a work-study program.

Heres how each affects the aid package that is offered to your student. The FAFSA does not ask about the value of accounts designed for retirement such as. Some Assets Are Not Counted but Still Affect Financial Aid Retirement accounts.

Some assets must be reported but will only reduce your aid by a percentage of their value. Will the amount I have in my investments affect my FAFSA. Besides income the FAFSA asks about a variety of different savings and asset values.

Applicants are required to report the net worth of their investments on the Free Application for Federal Student Aid FAFSA as of the date they file the FAFSA. Heres a look at which assets that will affect your EFC and will be factored in to your formula. The higher the value of the asset and or income extracted from the second home the nearer is the association of ownership is to the FAFSA applicant and the higher the possible decrement in the qualifications of FAFSA.

529 College Savings Plans and. And when you hold them they are an asset. NO its not an asset on the FAFSA as long as you or your directly-related family owns more than 50 and the business employs less than 100 people.

Unfortunately the asset protection allowance has been declining since 2009-10 and will drop even further with the 2016-2017 FAFSA. All of these factors may impact on the designation of the house as an asset and the quantum of the effect that the house has over the application of student aid. When they vest they add to your income.

This includes bank accounts and investment properties. How to Shelter Assets on the FAFSA. Answer 1 of 3.

The value of retirement plans such as 401k plans pension funds annuities non-education IRAs Keogh plans UGMA and UTMA accounts for. However 529 plans that are owned by grandparents are not counted as an asset when a student completes the FAFSA but some colleges do ask for grandparent-owned 529 assets as a. Any balances you have in your basic checking and savings accounts.

Impact of Assets on the FAFSA Reportable assets increase the expected family contribution EFC on the FAFSA and CSS Profile forms thereby reducing eligibility for need-based financial aid. For most applicants yes. It doesnt matter whether you keep the money in a safety deposit box or stuffed under your mattress.

Certain types of assets are not reported on the Free Application for Federal Student Aid FAFSA. NO its not an asset on the FAFSA. Failing to report the money is still fraud since you will be making a false statement on the FAFSA in response to the question about the total current balance of cash savings and checking accounts.

The impact of this change is discussed below including the legislative basis criteria for exclusion other exclusions special rules for business or farm debt and the relevance to rental properties. There are however several steps you can take to reduce the impact of assets on eligibility for need-based. Both income and assets play a role in the amount the family is expected to contribute.

Well explain how you can move. This is the definition of investm. A savings account does count as an asset but the effect depends on the type of savings account and who is listed as the owner.

The Profile will ask for more details including the business tax return. Luckily only some assets are reported on the FAFSA. Student assets will also affect the FAFSA EFC - they have no asset protection allowance and affect the EFC by 20 of their value.

Small Business Exclusion Since July 1 2006 small businesses that are owned and controlled by the family are excluded as assets on the Free Application for Federal Student Aid FAFSA. The equity available in the home you live in. For example the net worth of the familys principal place of residence is ignored on the FAFSA as are any small businesses owned and controlled by the family.

Likewise pensions 401k plans IRAs and other qualified retirement plans are ignored. So if you distribute your money strategically before submitting the form you may receive more financial aid. Failure to report assets on the Free Application for Federal Student Aid FAFSA is fraud.

Small businesses you own. The amount of financial aid a college student is eligible to receive is based on the data the student or his family provides in the Free Application for Federal Student Aid FAFSA. Heres our guide about which assets are reported on the FAFSA and how much each asset affects your aid.

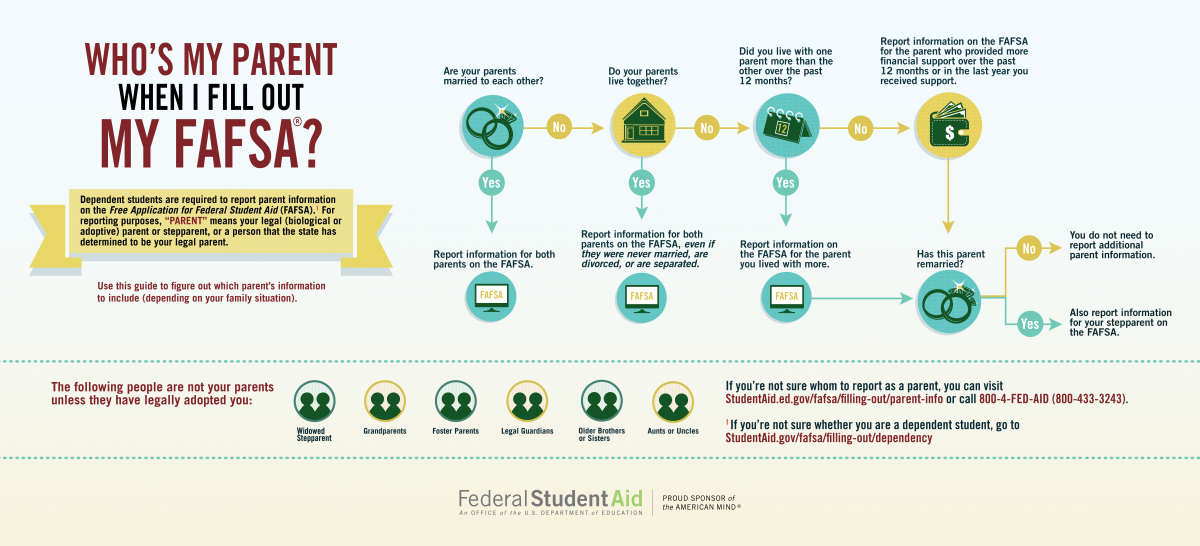

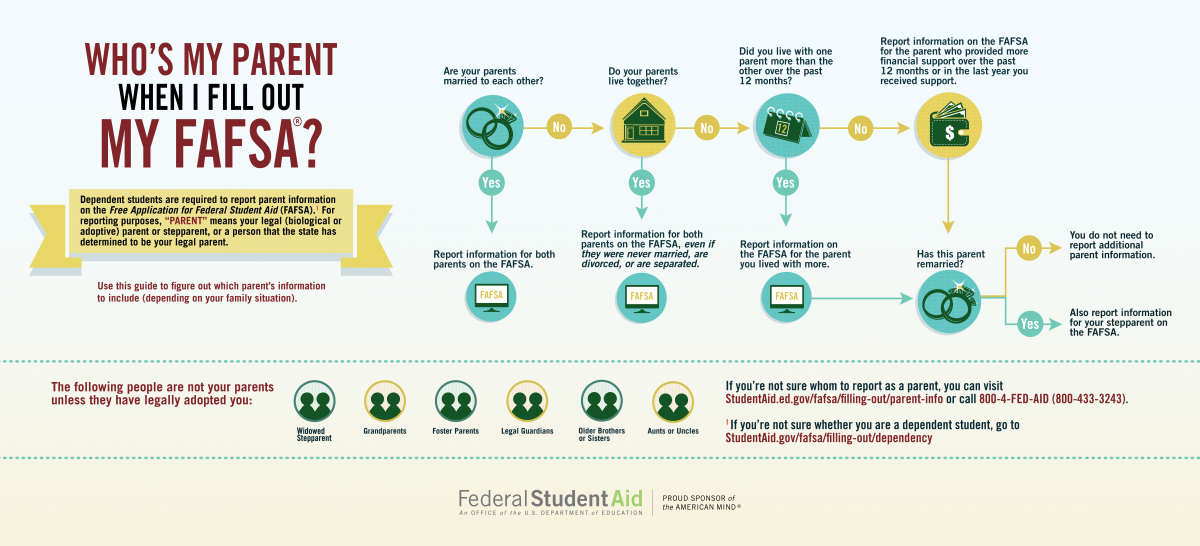

4 Fafsa Tips For Students With Divorced Parents

How These 6 Assets Might Affect Student Financial Aid Eligibility Student Loans Private Student Loan Paying Off Student Loans

How 7 Different Assets Can Affect Your Financial Aid Eligibility Financial Aid For College Fafsa Scholarships For College

Posting Komentar untuk "Do Assets Affect Fafsa"